Folks, hold onto your hats. The situation in the Red Sea has gone from simmering to boiling over in a matter of hours. The Houthi rebels in Yemen have just announced they will target all Israeli airports, a move that’s frankly, a massive escalation. And predictably, Israel hasn’t sat back and taken it. Reports are flooding in of intense Israeli airstrikes on critical ports in Yemen. This isn’t just regional instability anymore; this is teetering on the brink of a wider conflict.

Photo source:www.hindustantimes.com

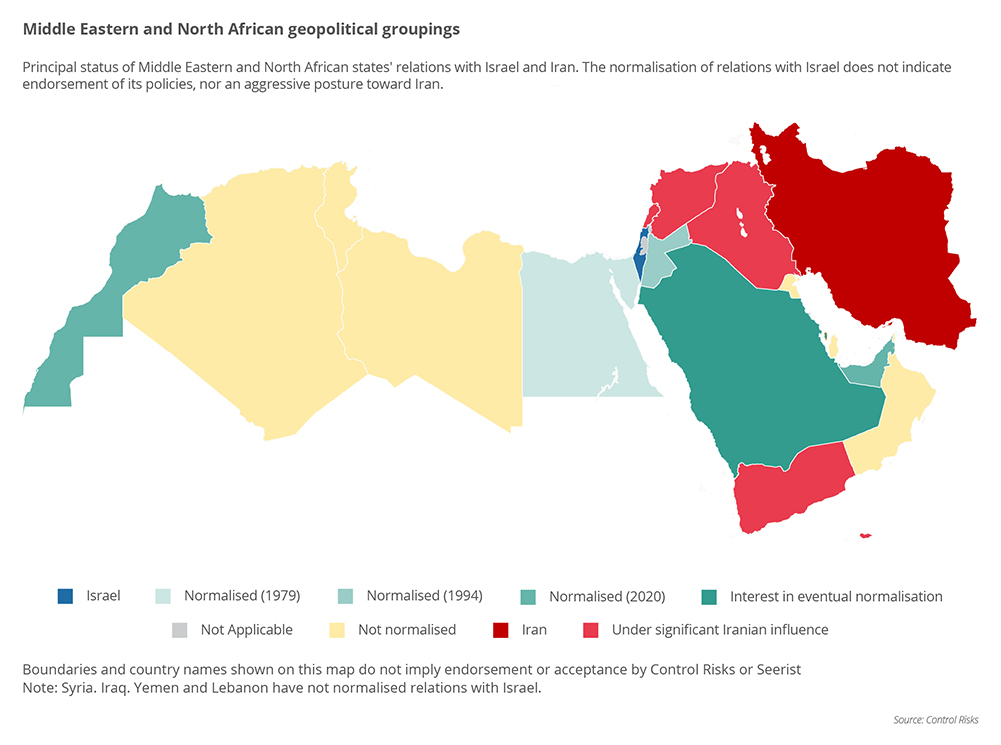

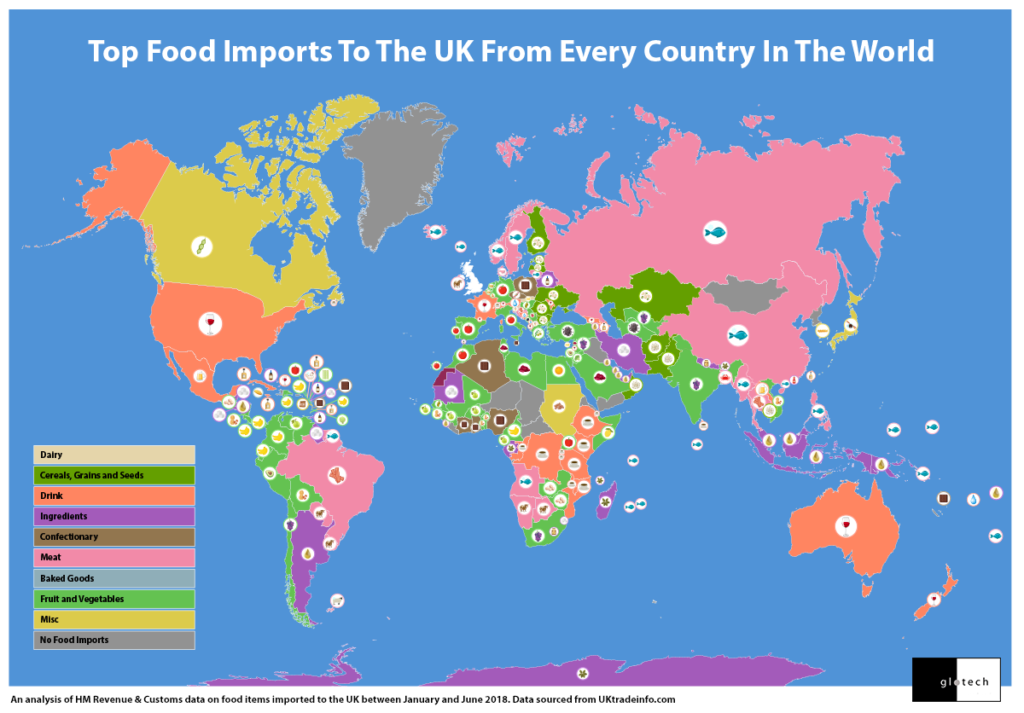

Let’s be clear: this is about more than just Israel and Yemen. This is about Iran’s proxies flexing their muscles, and it’s about the vital shipping lanes that the world relies on. The Bab al-Mandeb Strait, where much of this is unfolding, is a choke point for global trade, and disruption there will send ripples through the entire global economy.

Understanding the Geopolitics:

The Houthis, backed by Iran, are deepening their involvement in the Israel-Hamas war, framing their actions as solidarity with Palestinians. This expands the conflict beyond Gaza.

The Bab al-Mandeb Strait is strategically crucial, linking the Red Sea and the Gulf of Aden. Around 12% of global trade passes through this waterway.

Israel’s response is swift and forceful. The strikes against Yemeni ports are intended to degrade the Houthi’s capabilities. That said, they also risk further escalating the situation.

What does this mean for markets? Expect volatility. Oil prices are already edging upward, and any further disruption to shipping could lead to serious supply chain issues. Investors should brace themselves and be prepared for some turbulent times. Don’t let emotions dictate your holdings, but absolutely pay attention to the developments. This is not a drill.