Good morning, traders! We’ve seen a decidedly mixed bag in the domestic Chinese futures market this morning, a clear indicator of the ongoing uncertainty gripping the global economy. Gold, as expected, is leading the charge, surging over 2% – a powerful signal of risk aversion and a continued flight to safety. Silver, crude oil, international copper, and tin are also enjoying gains exceeding 1%, showing pockets of strength.

But don’t mistake this for a broad-based rally. We’re witnessing significant weakness in the energy and chemical sectors. Caustic soda, butadiene rubber, styrene, low sulfur fuel oil, and alumina are all down over 1%, a worrying trend. Natural rubber isn’t far behind, sliding almost 1%.

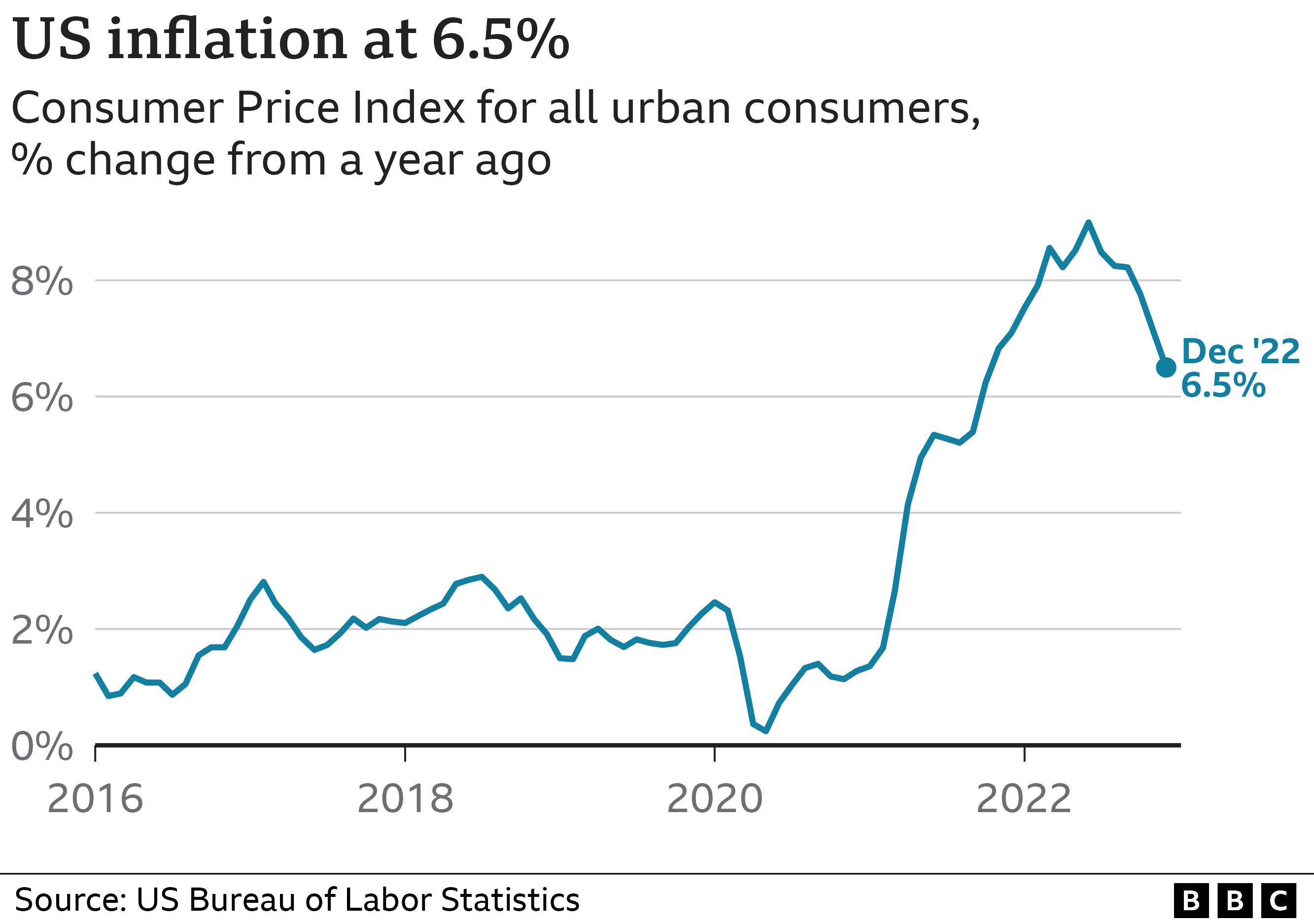

Let’s quickly unpack what’s happening here. The gold surge isn’t just random noise. It’s a direct response to increased geopolitical tensions and persistent concerns about inflation. Investors are scrambling for a reliable store of value, and gold fits the bill.

Commodities like crude oil and copper often reflect broader economic health. Their gains today suggest some optimism regarding future demand, though the picture remains clouded.

However, the substantial drops in chemical products hint at oversupply and dwindling demand, potentially signaling a slowdown in manufacturing activity. That’s a red flag we need to pay close attention to.

This volatility isn’t a surprise. We’re navigating a complex environment with multiple conflicting forces at play. Stay nimble, manage your risk, and don’t chase momentum blindly. This is not a market for the faint of heart.