Alright, folks, let’s cut through the noise. Citigroup Securities just dropped a report on the April US CPI, and the takeaway is…don’t get comfortable. While the numbers came in softer than expected – a gentle 2.3% year-over-year – this ‘good news’ is likely a mirage.

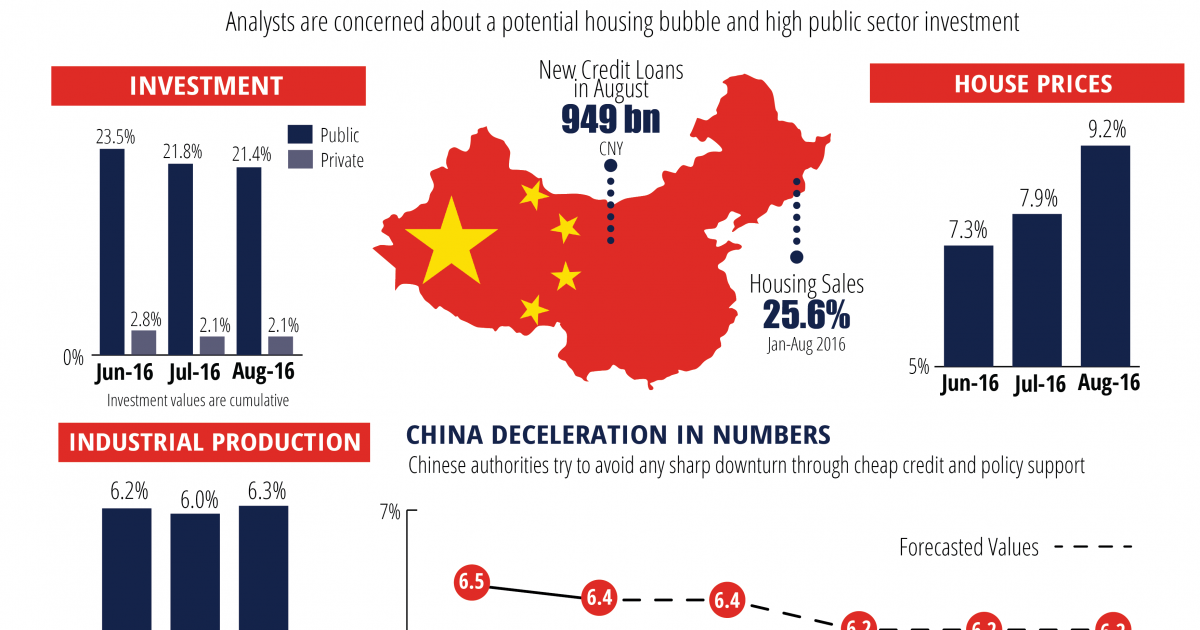

Photo source:www.delta-asia.com.hk

We’re already seeing early signs of the tariffs imposed by the White House starting to creep into prices, particularly in goods like furniture, appliances, and even toys. This month’s figure could very well be the lowest CPI we see all year.

Let’s talk numbers. A conservative estimate shows these tariffs, as they stand after the recent US-China joint statement, could pump up the US PCE price index by roughly 0.85%. More alarming? A long-term drag on US GDP, potentially shaving off around 0.3%.

To entirely offset the inflationary pressure from these tariffs, the Trump administration would need to slash prescription drug prices by a whopping 30% on average. That’s a big ask.

Here’s where it gets interesting: We’re starting to see the boundaries for US tariff policy – the ceiling and the floor. Increased policy transparency is a positive signal for risk assets like stocks, and we might see the US dollar find some support soon.

However, I remain cautiously pessimistic on US Treasuries. This isn’t a time for reckless optimism.

Digging Deeper: Understanding the CPI and Tariff Impact

The Consumer Price Index (CPI) measures changes in the price level of a weighted average market basket of consumer goods and services. It’s a key indicator of inflation.

Tariffs are taxes imposed on imported goods. While intended to protect domestic industries, they invariably increase costs for consumers and businesses.

The PCE price index is the Federal Reserve’s preferred inflation gauge, offering a broader view than the CPI.

The impact of tariffs isn’t immediate. It takes time for these costs to work their way through the supply chain and into final prices.