Friends, buckle up! The market is on fire, and it’s not just the summer heat. Rumors of a potential Israeli strike on Iranian nuclear facilities sent oil prices soaring yesterday. This isn’t just a blip; this is a warning shot across the bow of global energy markets.

We’re talking serious geopolitical risk here, folks. Iran is a major oil producer, and any disruption to its facilities—even the threat of disruption—immediately sends shockwaves through the system. It’s basic supply and demand. Less supply, higher prices. Period.

Let’s break down what’s happening and what it means for your portfolio. This isn’t about the intricacies of Iranian nuclear policy; it’s about the price of oil, and how that ripples through EVERYTHING.

Understanding the Geopolitical Risk Premium:

Firstly, understanding the ‘geopolitical risk premium’ is crucial. This is the extra amount investors are willing to pay for oil to compensate for the possibility of supply disruptions due to political instability or conflict.

This premium has spiked dramatically with the recent developments. Think of it as an insurance policy against chaos; it’s pricey, but the alternative could be catastrophic.

Secondly, Iran’s vast oil reserves, coupled with its strategic location, make it a key player in the global energy landscape. Any significant disruption to Iranian oil flow could send prices spiraling upward rapidly.

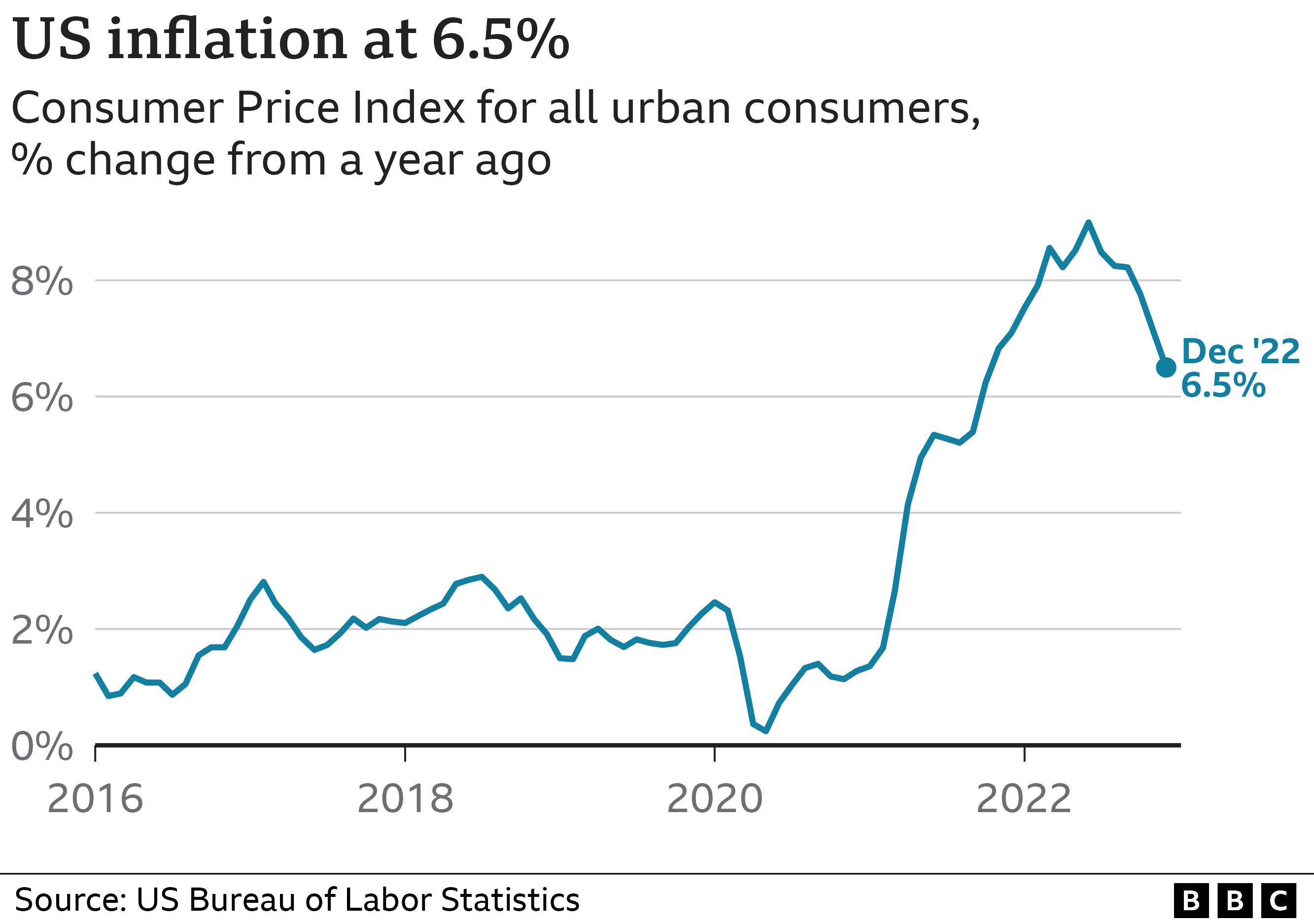

The impact isn’t limited to the pump. Higher oil prices fuel inflation, squeeze corporate profits, and potentially trigger a broader economic slowdown. It’s a domino effect we need to watch closely. And honestly, the market is already pricing in pretty significant escalation risks. Bottom line? Be prepared for volatility and consider hedging your energy exposure. This situation demands a proactive, not reactive, investment strategy.