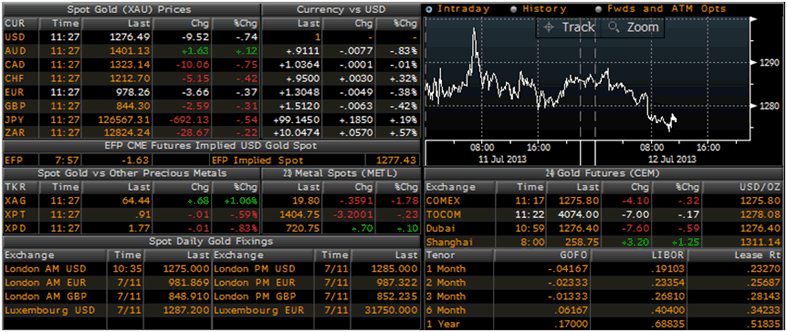

Friends, the Shanghai Gold Exchange (SGE) is already sending strong signals this Monday morning! Gold futures (T+D) are up a respectable 0.57%, currently trading at 777.01 yuan per gram. Silver isn’t lagging behind, jumping 0.39% to 8241.0 yuan per kilogram.

Now, before you go rushing to liquidate your portfolios and buy physical, let’s unpack this. This isn’t just about shiny metal; it’s about global risk appetite, inflation anxieties, and, frankly, a growing distrust in fiat currencies.

Let’s quickly break down why these price movements matter.

Firstly, gold traditionally acts as a safe-haven asset. When the world looks uncertain—geopolitical tensions, economic slowdowns—investors flock to gold.

Secondly, inflation is still a beast we haven’t slain. Real interest rates remain negative, making gold, which doesn’t yield interest, comparatively more attractive.

Thirdly, the yuan’s performance plays a role. A weakening yuan typically boosts demand for gold, as it becomes cheaper for domestic investors.

Don’t mistake this early rally for a confirmed trend, though. We need to see sustained momentum. However, it’s a clear indicator that the market is on edge, and precious metals are once again in the spotlight. Keep a close watch, especially as we enter a crucial week for economic data releases.