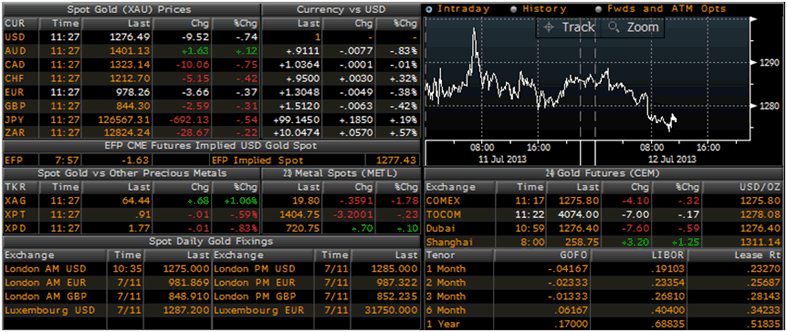

Alright folks, let’s cut straight to the chase. The Shanghai Gold Exchange opened lower this Tuesday, with gold’s T+D contract dipping 0.01% to 777.19 yuan per gram. A slight pullback, but nothing to panic about… yet.

Photo source:www.marketoracle.co.uk

However, the real story this morning is silver. Shanghai silver’s T+D contract is seeing a healthy jump, up 0.41% to 8278.0 yuan per kilogram. This divergence is screaming at us – a potential shift in risk appetite and maybe, just maybe, a blossoming vote of confidence in industrial metals.

Let’s unpack this a bit. Gold is often the go-to ‘safe haven’ asset. When things get shaky, investors flock to it. But when confidence returns, funds tend to rotate into riskier, growth-oriented investments… like silver.

Here’s a quick refresher on the dynamics at play:

Gold’s appeal lies in its historical role as a store of value, especially during times of economic uncertainty & geopolitical tension. It doesn’t yield income, but it tends to hold its value better than many assets during turbulent periods.

Silver, on the other hand, is both a precious metal and an industrial metal. Its demand is driven by both investment and industrial applications like electronics and solar panels. This dual nature gives it added growth potential.

Currently, price movements might also reflect broader macroeconomic trends and investor expectations about economic recovery. The interplay between inflation, interest rates, and global economic growth are major factors to watch.

Keep your eyes on the silver-gold ratio, people! It’s a powerful indicator of market sentiment. A rising ratio typically signals increasing risk appetite. Don’t just blindly follow the herd, do your research, and protect your portfolios!