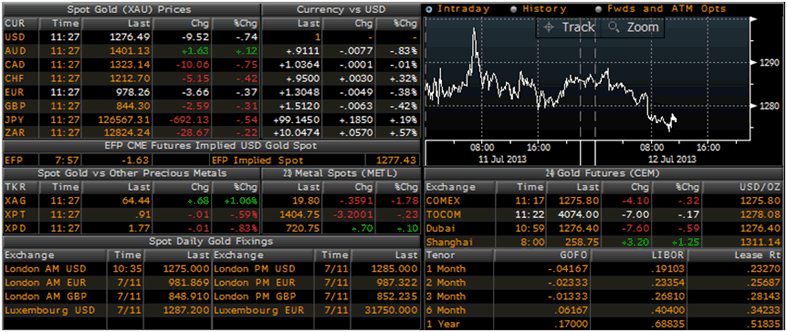

Alright, folks, let’s cut to the chase. The Shanghai Gold Exchange (SGE) threw us a curveball this morning. Gold futures (T+D) opened down 0.51%, hitting 769.5 yuan per gram. Not exactly the bullish signal many were hoping for.

Photo source:www.bullionstar.com

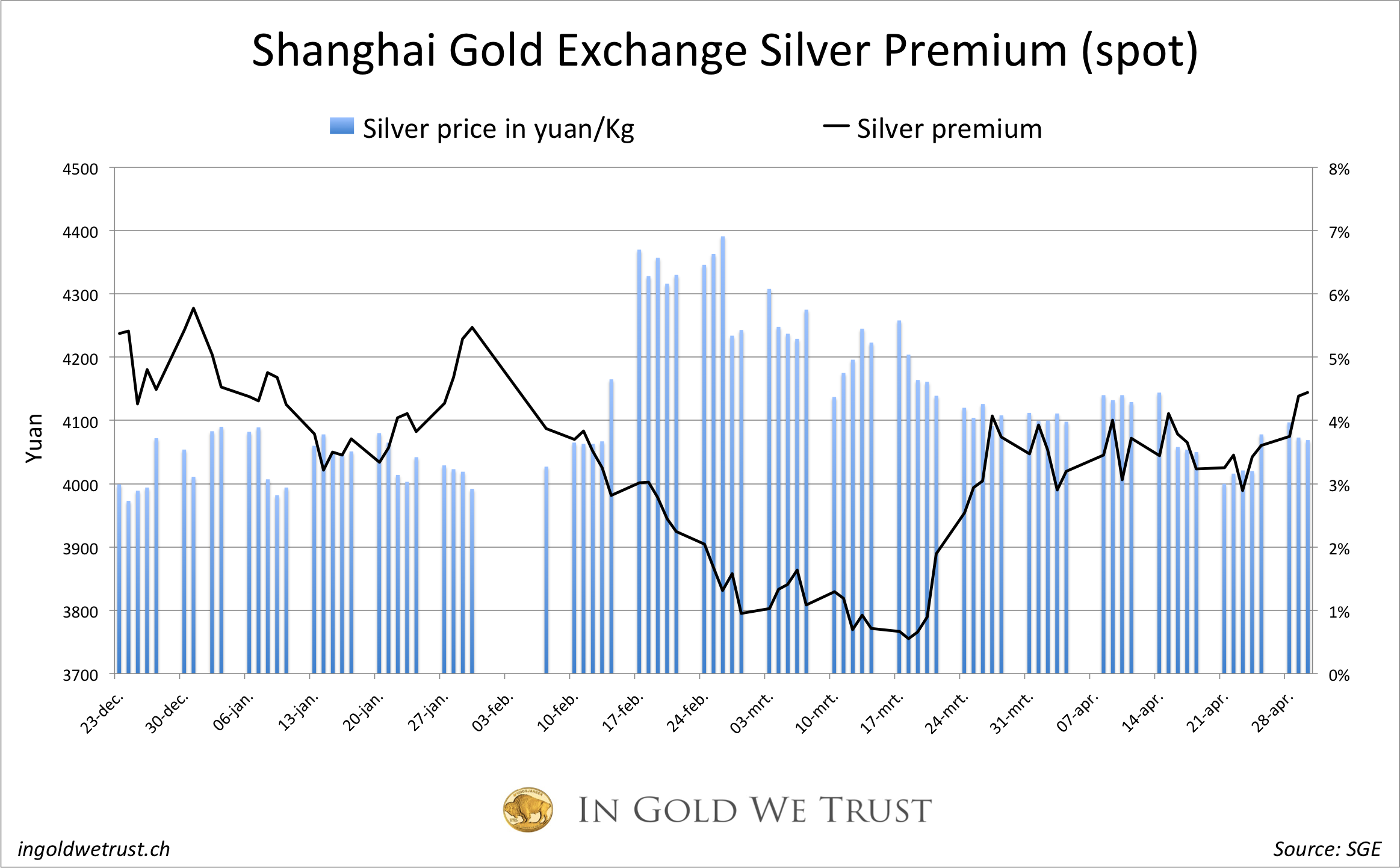

Now, don’t panic just yet. Silver, on the other hand, is showing a bit of resilience, edging up 0.11% to 8228.0 yuan per kilogram. This divergence is interesting, and we need to pay attention. What’s going on here?

Let’s break down what’s happening beneath the surface. The gold dip likely reflects a combination of factors: strengthening US dollar, easing geopolitical tensions (a little, anyway), and some profit-taking after recent gains. Investors are reassessing risk and a stronger dollar traditionally puts pressure on gold.

Here’s a quick primer for those newer to the precious metals game:

Understanding T+D: T+D refers to ‘transaction day plus delivery’. It’s the most actively traded contract on the SGE, meaning price movements here are crucial for gauging short-term market sentiment.

Shanghai’s Significance: The SGE is the global pricing hub for physical gold. What happens in Shanghai doesn’t stay in Shanghai; it ripples across global markets. It matters, big time.

Gold & Silver Dynamics: Gold and silver often move in tandem, but not always. Silver has industrial applications, giving it an added layer of complexity and sometimes allowing it to outperform gold during periods of economic optimism.

The Big Picture: I’m seeing this as a potential short-term correction in gold, not a complete reversal. Keep a close eye on the dollar’s trajectory and any further developments regarding global events. Opportunities could arise from this volatility. Don’t get emotionally carried away – stick to your strategy! This is a time for prudence, not impulsiveness.