Hold onto your hats, folks! The Shanghai Gold Exchange saw a fiery start to Wednesday trading. Gold futures (T+D) rocketed up a stunning 2.75% in the early hours, hitting 773.23 yuan/gram. Silver wasn’t left behind either – jumping 2.08% to 8240 yuan/kilogram.

Photo source:www.forexlive.com

This isn’t just noise. We’re witnessing a clear flight to safety, a signature move when global economic anxieties spike. Let’s break down why these precious metals are suddenly so attractive.

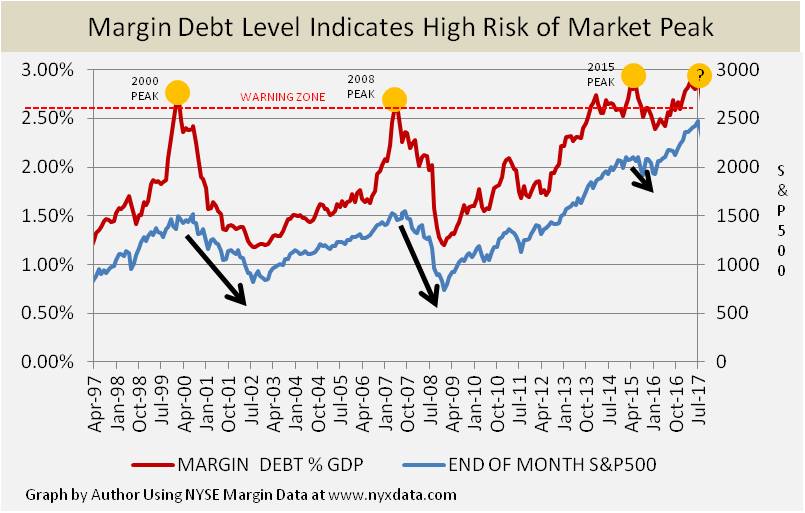

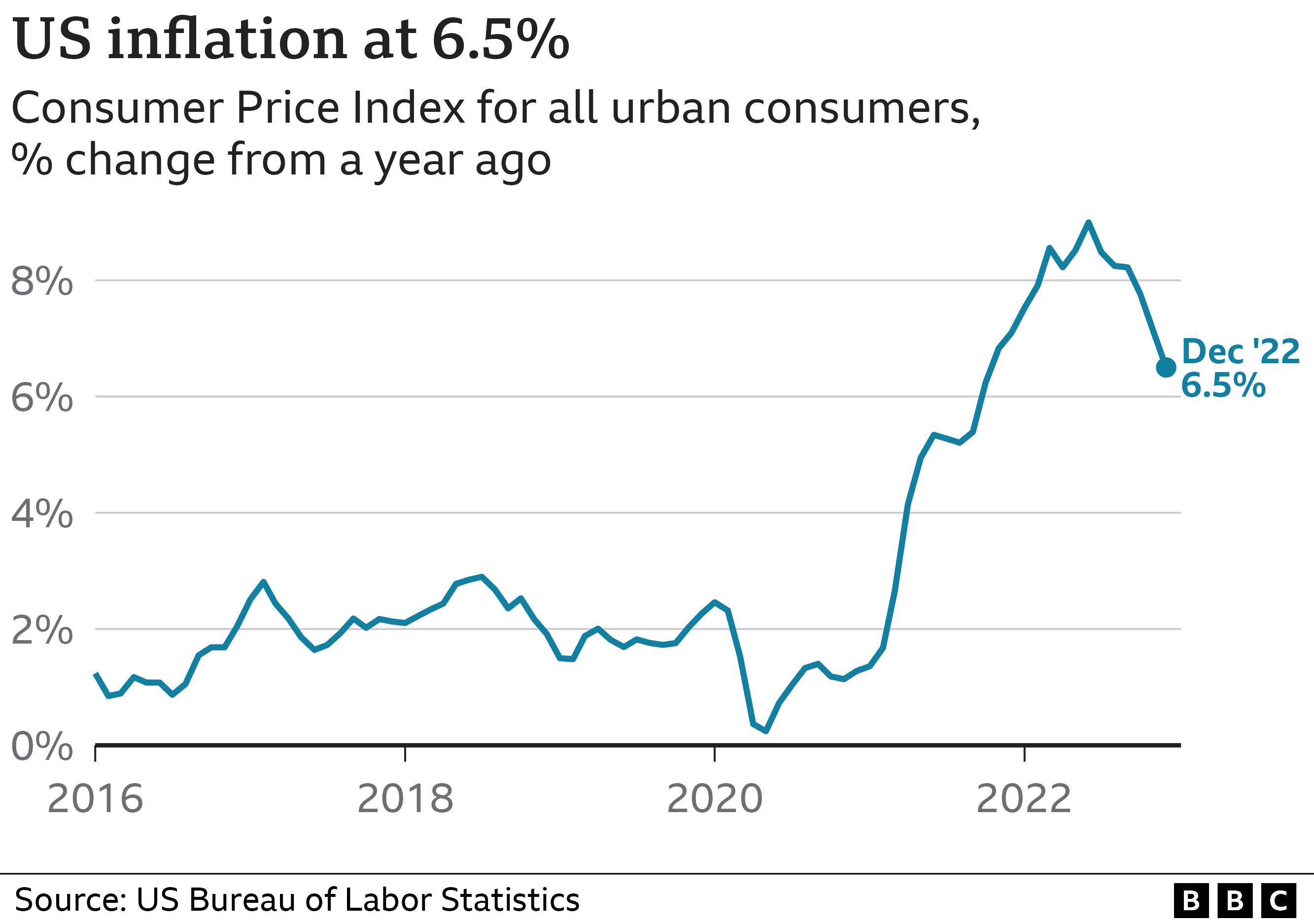

Firstly, gold is historically a hedge against inflation and currency devaluation. With global inflation showing no signs of a swift retreat, investors are piling into gold as a store of value.

Secondly, geopolitical tensions are escalating practically daily. From ongoing conflicts to trade wars, uncertainty breeds demand for safe-haven assets – and gold has always been the king of safe havens.

Finally, don’t forget the technical factors. A key resistance level was decisively broken for gold, triggering further buying momentum. Silver, often trailing gold’s performance, is now catching up, offering a compelling opportunity for those brave enough to play it.

This morning’s surge is a stark reminder: these aren’t just commodities; they’re barometers of global economic mood. Pay attention – the signals are loud and clear.